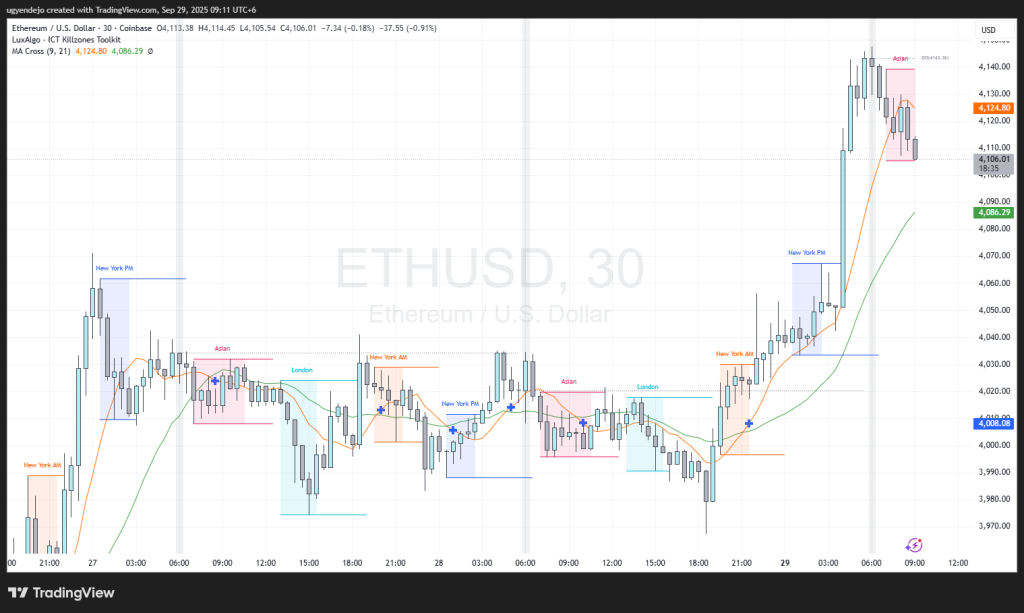

🔎 Market Structure

- Consolidation Phase:

- Between Sep 27–28, price ranged sideways (Asian, London, NY sessions overlapped with small sweeps).

- Perfect liquidity buildup on both sides.

- Accumulation → Expansion:

- Notice NY AM (Sep 28 ~21:00): price swept London low, created a bullish ChoCH.

- Expansion followed → NY PM breakout and continuation.

- Strong Rally (Sep 29 AM):

- Price broke above 4060, running all liquidity resting above prior highs.

- Aggressive expansion → up to 4140s.

- Now pulling back into Asian range (4120–4100).

Ads:

- 📈 Open a LIVE Trading Account with Vantage Markets

- 🔐 Get RedotPay Crypto Wallet & Card for Transactions

- 🤖 Automate your Trades with our AI powered services

- 🎓 Free Mini Course to Start Trading – Beginner’s Guide

🎯 Entry Opportunities

- Buy Setup (Sep 28, ~21:00 – NY AM)

- Entry: ~4000–4010 (OB retest after ChoCH)

- SL: ~3980

- TP1: 4060 (NY PM high)

- TP2: 4140 (today’s high)

- R:R ≈ 1:4 ✅

- Buy Setup (Sep 29, ~03:00 – NY PM)

- Entry: ~4050 after EMA 9/21 bullish cross + breaker retest

- SL: ~4025

- TP: 4140

- R:R ≈ 1:3 ✅

- Scalp Short (Current Price Action)

- Price tapped Asian high (4140–4135) and rejected.

- Possible short-term pullback.

- Entry: 4125–4130

- SL: 4145

- TP1: 4100

- TP2: 4085 (near EMA 21 + demand)

⚡ Bias

- Main Bias: Still bullish unless 4080 breaks down.

- Current Trade: Look for short pullback scalps → then reload longs near 4085–4100 targeting 4160–4180.

WE ARE LIVE

by ugyen dorji