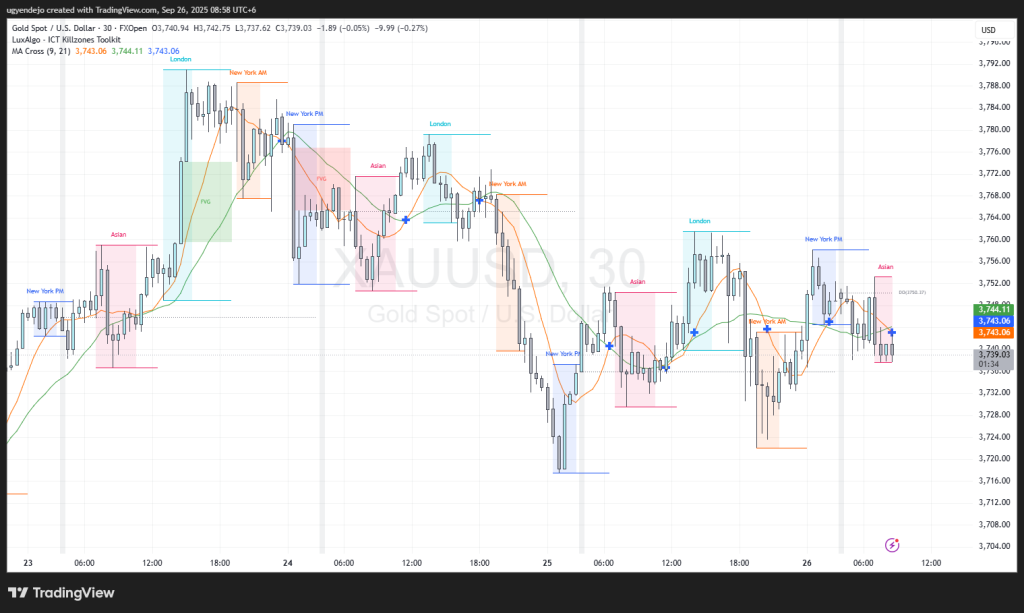

🌍 Market Snapshot

Gold 🪙 is trading around $3,743 after a highly volatile week 📊. Yesterday saw strong bearish momentum 📉 taking price down to $3,720, before rebounding into the $3,750s during London. Now, Asian session is consolidating again just under the EMA cluster ⚖️.

Ads:

- 📈 Open a LIVE Trading Account with Vantage Markets

- 🔐 Get RedotPay Crypto Wallet & Card for Transactions

- 🤖 Automate your Trades with our AI powered services

- 🎓 Free Mini Course to Start Trading – Beginner’s Guide

🏗 Smart Money Structure

- Price is swinging in a CHoCH environment ⚠️ → ranging between $3,720 – $3,755.

- FVGs 🔲 seen both above and below current price, confirming liquidity traps.

- EMA cross (9/21) is flat ➡️ → market indecision, waiting for expansion.

⏰ Session Outlook

- Asian Session: Consolidation 🔄 in a tight range, building liquidity.

- London Session: Expecting a sweep of $3,748 – $3,752 for liquidity grab 🎯.

- New York Session: Likely expansion move 💥 → direction will depend on which side breaks first.

📰 Market Drivers & News Outlook

- Dollar index 💵 remains strong but losing momentum → Gold reacting with choppiness.

- US PCE inflation data later today 📰 → high-impact, likely driving NY volatility.

- Positioning ahead of next week’s FOMC outlook continues ⚡.

📋 Trade Plans (with emojis 🎯🔥🛡️)

✨ Plan A (Bearish Liquidity Grab – Primary Bias):

- 🔻 Sell Zone: $3,748 – $3,752 (FVG + liquidity sweep zone)

- 🎯 TP1: $3,732

- 🎯 TP2: $3,720

- 🛡️ SL: $3,758

✨ Plan B (Bullish Expansion – Contingency):

- 🟢 Buy Zone: $3,722 – $3,728 (sweep of yesterday’s NY low)

- 🎯 TP1: $3,740

- 🎯 TP2: $3,752

- 🛡️ SL: $3,716

🧭 Final Bias – ICT Narrative

Today is likely a liquidity hunt day 🎯 → both sides may get trapped before a clean expansion. My primary bias is bearish 🐻 → expecting London/NY to run above $3,750 before pushing down into $3,720s.

Bullish case 🐂 only activates if $3,752+ is reclaimed with strength.

WE ARE LIVE

by ugyen dorji