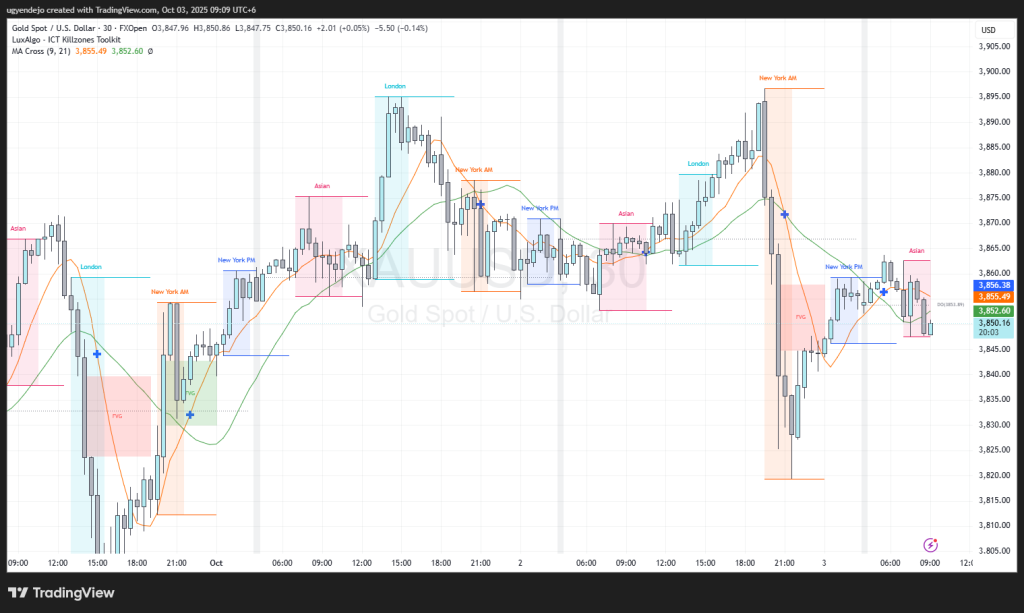

📌 Market Snapshot

- Current Price: $3,850

- Key Sessions: Asian consolidation → London rally → NY AM selloff → NY PM retracement

- Bias: Range-to-bearish short-term, unless 3,870 is reclaimed.

Ads:

- 📈 Open a LIVE Trading Account with Vantage Markets

- 🔐 Get RedotPay Crypto Wallet & Card for Transactions

- 🤖 Automate your Trades with our AI powered services

- 🎓 Free Mini Course to Start Trading – Beginner’s Guide

📉 Smart Money Structure (ICT)

- Daily Bias: Neutral to Bearish.

- Liquidity Sweeps: London took liquidity above $3,890 then sold off.

- Fair Value Gaps (FVGs): NY PM left imbalance around 3,860 – 3,870.

- Order Blocks: Bearish OB near 3,895 holding as resistance.

🕒 Session Outlook

- Asian: Sideways, created equal lows.

- London: Strong push above 3,880 → then reversal.

- NY AM: Bearish dump into 3,850.

- NY PM: Small retracement, but still capped below 3,870 OB zone.

🌍 Market Drivers & News

- USD Index showing strength → Gold under pressure.

- Bond yields slightly higher → bearish for Gold.

- Market waiting for US Jobs Data (NFP week) → expect volatility.

🎯 Trade Plan

📌 Setup: Look for sell retracement into OB / FVG around 3,865 – 3,870.

- Entry Zone: 3,865 – 3,870 🟠

- Stop Loss (SL): 3,880 🔴 (~100 pips)

✅ Take Profits:

- 🥇 TP1 → 3,840 (250 pips)

- 🥈 TP2 → 3,820 (450 pips)

- 🥉 TP3 → 3,800 (650 pips)

📌 Final Bias – ICT Narrative

- Expect retracement sells below 3,870 OB zone.

- As long as 3,880 holds, market favors bearish continuation.

- Watch for liquidity grabs around Asian lows (3,845).

WE ARE LIVE

by ugyen dorji