🌍 Market Snapshot

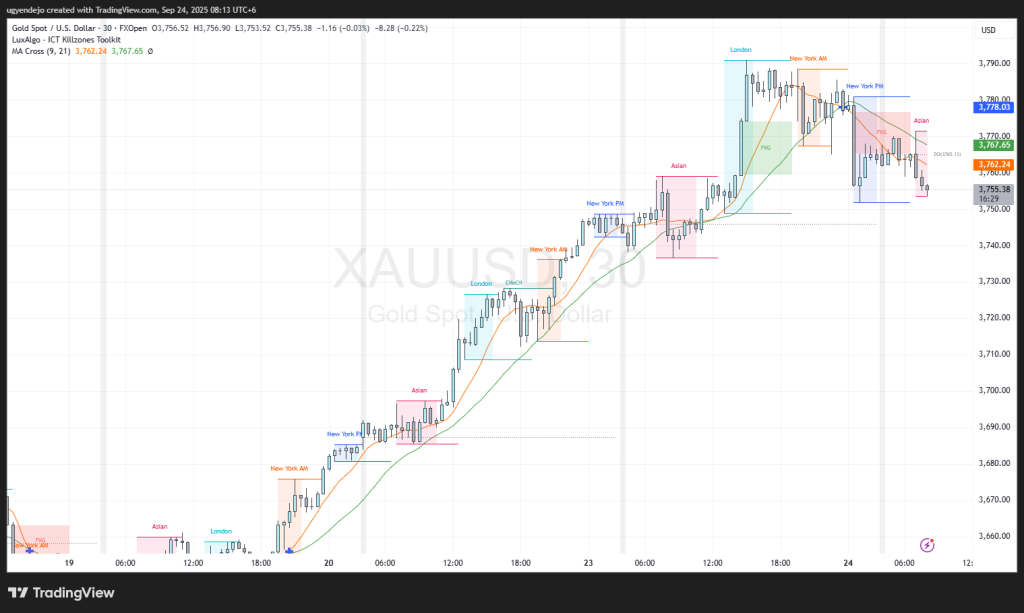

Gold 🪙 is currently trading around $3,762 after retracing from the highs near $3,778. Yesterday’s bullish move during London and New York AM sessions pushed price upward, but late New York and Asian session brought a corrective pullback 📉.

Ads:

- 📈 Open a LIVE Trading Account with Vantage Markets

- 🔐 Get RedotPay Crypto Wallet & Card for Transactions

- 🤖 Automate your Trades with our AI powered services

- 🎓 Free Mini Course to Start Trading – Beginner’s Guide

🏗 Smart Money Structure

- Market is in a bullish structure 🔼 with higher highs (HH) and higher lows (HL).

- Current pullback is testing FVG imbalance zones 🔲 created on the 30M chart.

- 9/21 EMA crossover is still bullish ✅, but short-term correction is visible.

⏰ Session Outlook

- Asian Session: Consolidation and minor sell-side liquidity sweep 💧.

- London Session: Watch for bullish continuation setups after liquidity grab 📊.

- New York Session: Possible expansion back toward $3,778 – $3,785 🎯.

📰 Market Drivers & News Outlook

- USD strength ⚡ is cooling down, providing Gold support.

- Traders await US economic data later today, which could spark volatility 📢.

- Risk sentiment remains mixed with equities stabilizing.

📋 Trade Plans

✨ Plan A (Bullish Bias):

- Buy near $3,755 – $3,760 (FVG + EMA support) 💎

- TP1 🎯: $3,770

- TP2 🎯: $3,778

- SL ❌: $3,747

✨ Plan B (Bearish Continuation if breakdown):

- Sell below $3,750 if liquidity sweep fails 🔻

- TP1 🎯: $3,740

- TP2 🎯: $3,728

- SL ❌: $3,762

🧭 Final Bias – ICT Narrative

The market remains bullish overall 🚀, but with short-term corrections before further continuation. Expecting London session to engineer liquidity below $3,755 and then push upward toward $3,778+.

WE ARE LIVE

by ugyen dorji