Market Snapshot

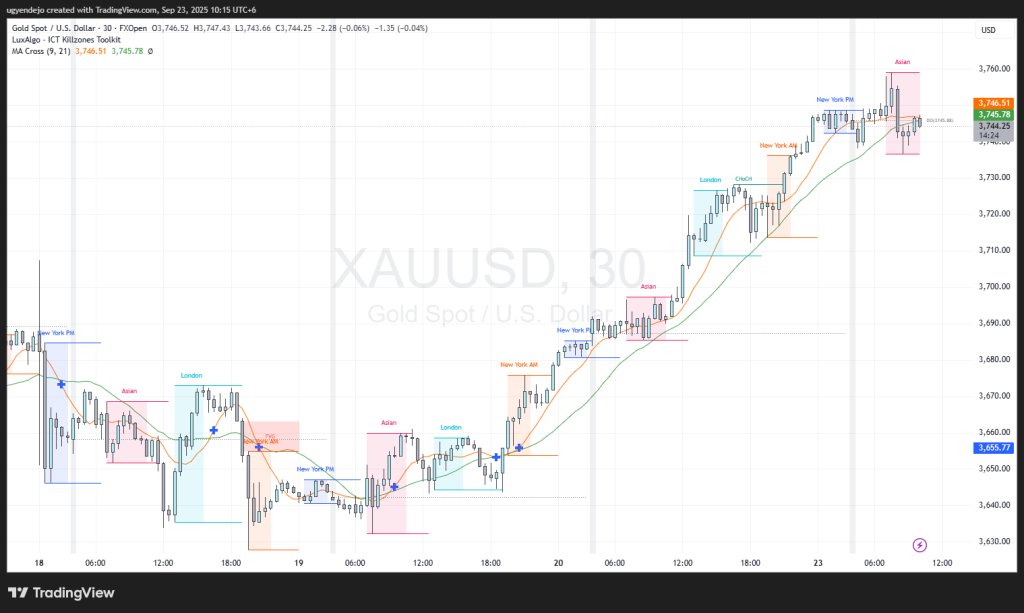

Gold is trading around $3,745 after an impressive multi-day rally from the $3,635 lows. 📈

The market has been printing higher highs & higher lows, riding the EMA cross bullish momentum. Current price is consolidating inside the Asian session high ($3,747). Liquidity sits above at $3,755–$3,760, which could be the next target.

Ads:

- 📈 Open a LIVE Trading Account with Vantage Markets

- 🔐 Get RedotPay Crypto Wallet & Card for Transactions

- 🤖 Automate your Trades with our AI powered services

- 🎓 Free Mini Course to Start Trading – Beginner’s Guide

Session Outlook

- Asian session: Consolidation inside a tight range $3,743–$3,747.

- London session: Possible sweep of Asian lows before expansion.

- New York session: Likely to target $3,755–$3,760 liquidity unless strong rejection occurs.

Market Drivers & News Outlook

- USD Index remains under pressure 🏦, supporting Gold’s bullish trend.

- Traders eye upcoming U.S. data releases later in the week (GDP & inflation), which may bring volatility.

- With no major catalysts today, expect liquidity engineering in London and New York.

Trade Plans

- 🟢 Scenario 1 (Bullish Continuation)

- 🔍 Look for liquidity sweep into $3,735–$3,730 discount zone.

- 📈 Go long if bullish displacement confirms.

- 🎯 Targets: $3,755 → $3,760 highs.

- 🚨 Invalidation: Close below $3,725.

- 🔻 Scenario 2 (Intraday Pullback)

- ⚡ If London/NY runs $3,755–$3,760 liquidity and fails.

- 🔽 Short opportunity back into $3,735–$3,730.

- 🎯 First target: $3,730 liquidity sweep.

Final Bias – ICT Narrative

Gold remains in bullish order flow, with momentum favoring continuation toward $3,760.

Base case: London sweep of lows, then New York expansion higher 🚀.

Alternative: Liquidity run at $3,755–$3,760, then corrective pullback into $3,730 zone.

WE ARE LIVE

by ugyen dorji